In this section, we will discuss the export process for Argentina. This will include an analysis of the documents, inspection and customs procedures that must be completed in order to export a product from Argentina to another country. We will also take a look at the export process for a product in order to give an example of the various steps that a product must go through prior to leaving the country.

Export Process

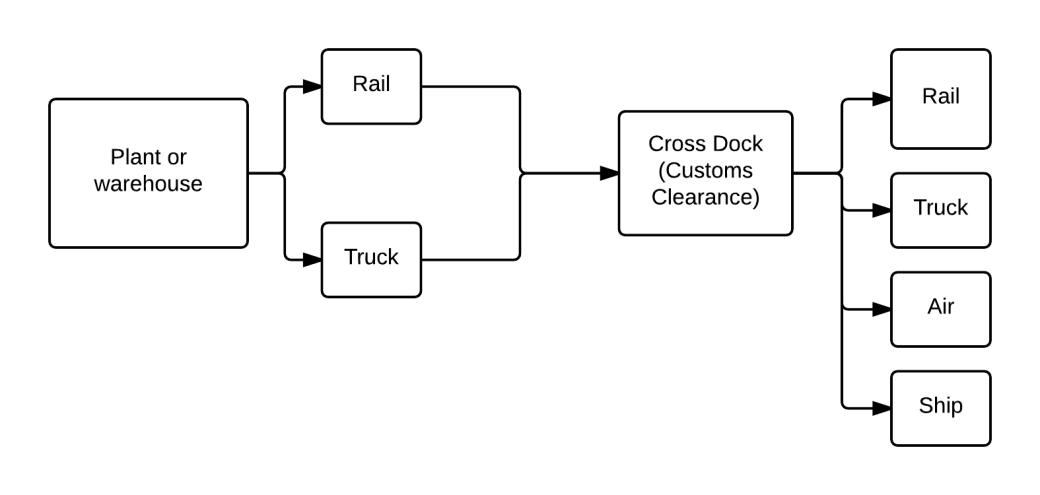

The export process for Argentina includes many steps. The process diagram above shows a very general export process for a product that is going to be exported from Argentina to another country. This process will change based on the specific product that is being exported as various government agencies and ministries that may be involved in the process have differing requirements and inspection methods. Below, you will find an explanation of the various steps that must be completed in order to export a product, along with an example of the process for exporting wine.

Registration for an Export License

First, a company must register with the Argentine government in order to export anything from Argentina. To do this, a company must go the the AFIP‘s website and register by filling out Registro de Operadores de Comercio Exterior (Registration for International Business Operations). Additionally, this is a one time process that needs to be completed. If a company needs to update any information regarding their license, they can change all information pertinent to their license on the AFIP’s website on the page entitled Sistema Registrar. It is important to note that this license authorizes a company to be an exporter, but it does not mean that the company’s products have been cleared to be exported from the country.

The second step that a company needs to complete in order to get its products cleared for exportation is getting all of the documentation and inspections from the relevant government agency. A company must work with the relevant government agencies in order to certify their quality, health and safety before it can start the customs process. The relevant government agency that needs to inspect the products, depends on the type of product that a company plans to export. The following provides a list of the relevant government agencies for specific types of products:

- Food for human consumption: INAL (Instituto Nacional de Alimentos – National Food Institute)

- Product, by-products and products derivatives from plants or animals: SENASA (Servicio Nacional de Sanded Animal – National Service for Animal Health and Safety)

- Wine: INV (Instituto Nacional de Vitivinicultura – National Institute of Viniculture)

- Medicines and products for use in the medical industry: ANMAT (Administración Nacional de Medicamentos, Alimentos y Tecnología Médica – National Administration of Medicine, Food and Medical Technology)

- Narcotics and psychotropics: SEDRONAR (Secretaría de Programación para la Prevención de la Drogadicción y Lucha contra el Narcotráfico )

- Flora and Fauna: Secretaría de Ambiente y Desarrollo Sustentable Secretaria for the Environment and Sustainable Development

These institutions emit the necessary documentation for Argentine customs that allow for the exportation of products. Also, it is possible for a company to register itself with the relevant government agency if it will only export products that fall under its jurisdiction.

How do you know which export tax/tariff is relevant to your product?

The next step is to consulte Argentina’s Customs Agency’s database of all of the harmonized tariff codes. A company needs to find the exact harmonized tariff code for its product(s) in order to determine what documents are necessary for customs in Argentina as well as in the country of destination. The customs codes are based on the World Trade Organization’s (WTO) Harmonized Commodity Description and Coding System (Harmonized System) established at the Uruguay round of the GATT (General Agreement on Tariffs and Trade). The Harmonized System code is relevant to find out which specific tax, technical and tax documents must accompany a product. This is why it is very important to use the correct product code. In order to find out what the requirements are for various customs codes, you can utilizes a website from the Argentinian government.

Customs Procedures

There are several restrictions placed by the Argentine government on products designated for export that one needs to be aware of before starting customs proceedings. First, under any circumstances, the Argentine government prohibits the exportation of any artifact from the country. Second, flowers and plants that are endangered or listed as being threatened with extinction cannot be exported under any circumstance. Finally, the Argentine government can temporarily ban the exportation of products due to a shortage of these products in the domestic market. Products that can be subject to this temporary ban are meat, dairy products, produce, wheat, corn and other foodstuffs.

Export Taxes

Some products do have an export tax that must be paid prior to the product’s exportation. The tax rate varies from product to product, and must be verified with AFIP. For example, petroleum exports are subject to a 40% export tax, and soy products can be taxed from 6 to 34% depending on their soy content.

If you are planning to export the products to a Mercosul member country, the export taxes maybe dropped or applied at a preferential rate. Further, there are no travel restrictions on products traveling to another Mercosul member country. However, if a product is destined for another country, Customs clearance is necessary. The Customs officials will check the export declaration, and may order additional inspections or documentation before a product can be cleared. It should be noted that the export declaration does not need to be extremely detailed for this process. Additional documents that need to be provided must document the origin of the product, as well as the relevant tariff the goods are subject to and the value of the goods.

Documentation Needed For Each Mode of Transportation

For maritime transportation, the following transportation document(s) are needed to export a product:

- Bill of Lading (Conocimiento de Embarque)

- Issued by the carrier, captain or maritime agent 24 hours before the ship is to depart

- Proof of transportation contract

- Proof of ownership of merchandise

- Statement that acknowledges the state of the goods at the time of receipt

- Limpio (clean): the captain acknowledged that the goods have been received in perfect condition

- Sucio (dirty): the captain expresses concerns regarding the state of the merchandise

- Directo (direct): when the merchandise is loaded at the cargo port and it is unloaded with direct service

- Mixto (mixed): when there is no direct service done to the merchandise

- Embarcado (loaded): a reception of the merchandise when it is loaded on board the ship

- Para embarque (for departure): an acknowledgement that the merchandise has been received after the ship’s departure

For air transportation, the following transportation document(s) are needed to export a product:

- Airway Bill (Guía Aerea)

- Must be issued by an agent of the International Air Transportation Association (IATA) that authorizes an air carrier

- Non-negotiable document that does not involve property, like the Bill of Lading, and requires the following documents:

- Functions as a proof of the transportation contract

- Is proof of the receipt of the merchandise by the carrier

- Freight invoice

- Insurance certificate

- Customs release

For truck transportation, the following transportation document(s) are needed to export a product:

- Inland or Ground Bill of Lading (Carta de Porte)

- Legal certificate of ownership between the loader and the carrier

- Proof of cargo

- Functions as a credit instrument

- Includes the various methods that the cargo will be transported:

- to the carrier (al portador)

- nominative (nominativo)

- to order (al orden)

- single mode (unimodal)

- contiguous (conjunta)

- indistinct (indistinta)

For rail transportation, the following transportation document(s) are needed to export a product:

- Railroad Bill of Lading (Carta de Porte)

- Legal certificate of ownership between the loader and the carrier

- Proof of cargo

- Functions as a credit instrument

- Includes the various methods that the cargo will be transported:

- to the carrier (al portador)

- nominative (nominativo)

- to order (al orden)

- single mode (unimodal)

- contiguous (conjunta)

- indistinct (indistinta)

For multimodal transportation, the following transportation document(s) are needed to export a product:

- Knowledge of multimodal transportation

- Conocimiento FIATA (Federación Internacional de Asociaciones de Transportistas y Afines)

Sources: