Here we will discuss currency considerations for the Argentine Peso. We will look at the cross-rates of the Argentine Peso and the currencies of Brazil, China, Japan, the United Kingdom and the United States. Additionally, we will provide a currency forecast for 2016, and offer our analysis of the forecast. The slide show below shows the cross-rates for the Argentine Peso against the 5 main reserve currencies (US dollar, Euro, British Pound, Japanese Yen and the Chinese Yuan). We used historic cross-rate from January 2000 to February 2016. These historic cross-rate show the impact of the country’s debt defaults on the nation’s monetary policy.

The Impact of the Debt Defaults on the Peso

The chart you see above shows the historic default probabilities for the Argentine 1-year and 5-year bonds. The three red bars on the charts show the sovereign debt defaults. Look closely at the slide show above for how the Peso‘s value changes in 2001 and 2014. For most of the currencies, there is a sharp devaluation of the Peso in 2001. In 2014, the Peso devalues again sharply at the beginning of the year. While a weak currency might be good for imports, the sharp, abrupt changes to the currency have severe impacts on companies’ operations as well as the larger economy. Companies find that sourcing materials, machines and inputs necessary to manufacture products become vastly more expensive than when purchase orders were issued. Additionally, their existing orders with clients become cheaper. Further, this abrupt change in the value of the Peso would also impact demand and production planning for the future. These changes in the value of the Peso require companies to reanalyze their total cost of ownership for each product and service that they provide in order to adjust sourcing, pricing and manufacturing strategies.

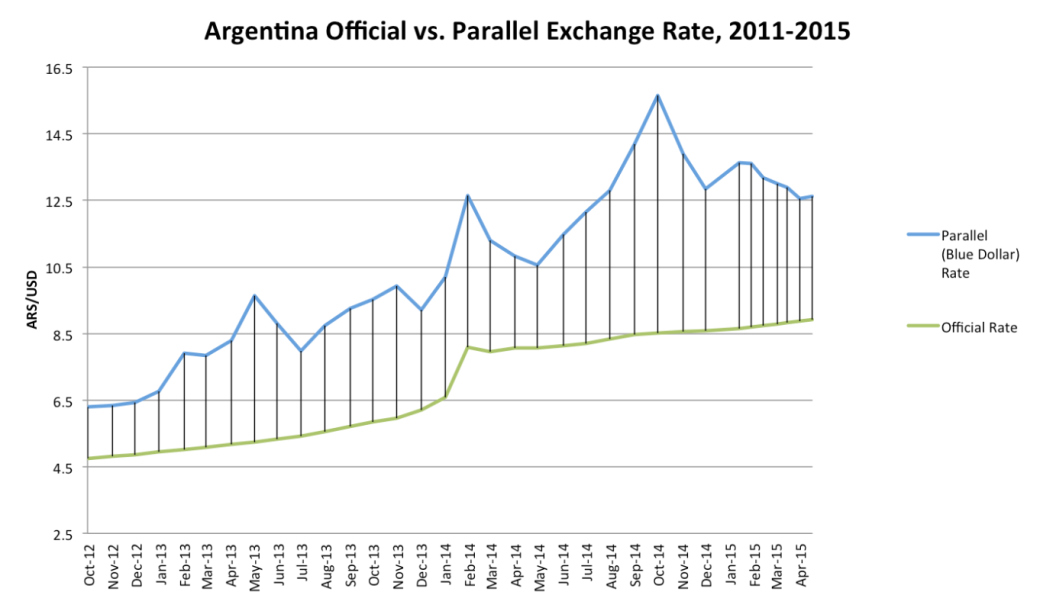

Another issue that sharp changes in the value of the Peso cause is the implementation of capital controls by the government to limit the amount of foreign exchange that leaves the country. These capital controls target both business and individuals. In 2001, the devaluation of the Peso meant that Argentina had to give up its currency peg, and allow the Peso to float. In 2014, the administration of then-president Fernanda Kirshner implemented stricter capital controls on dollars that has helped foster the parallel blue dollar market (Gendreau and McLendon, 2016). However, a combination of high inflation and the devaluation of the peso brought on capital controls in 2012 (The Economist).

Argentina has two exchange rates, the official rate and the blue rate – or the unofficial rate (see chart above). This spread between the official and blue rates can be interpreted as one measure of perceived risk in Argentina, and certainly provides huge opportunities to make money. It is possible to get an exchange rate that is as much as 30% better than the official rate. This has led to many Argentines wanting to get ahold of dollars to insulate themselves from worsening economic conditions. Additionally, due to this perceive risk, many business, hotels, restaurants and shops will even quote their prices at close to the blue rate for foreigners (The Economist, 2012; The Guardian, 2014). The blue dollar is such an ingrained facet of life that Twitter accounts (see DolarBlue and ValorDolarBlue) and local newspapers even provide daily quotes of the blue dollar rate. An added area of risk is that people do not trust the official inflation statistics which makes price uncertainty more of an issue, particularly when dealing with overseas clients.

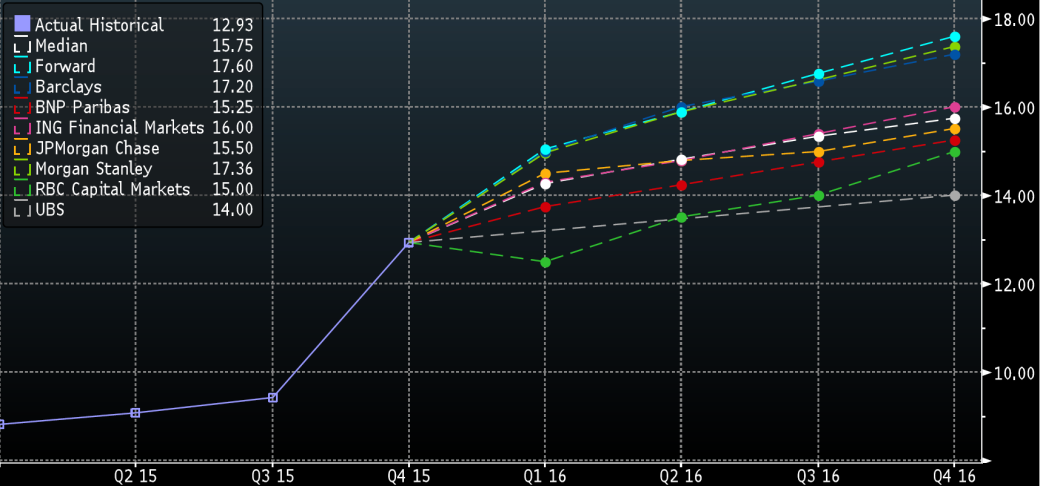

USD-ARS Currency Forecast for 2016 (Bloomberg)

Source:

- Baker, Vicky (2014). “Argentina and the ‘blue dollar’: what tourists need to know.” The Guardian.

- Bloomberg L.P. (2016). Currency cross-rates for the Argentine Peso 01/01/2000 to 02/13/2016. Retrieved Feb. 13, 2016 from Bloomberg database.

- The Economist (2012). “The blue dollar: Another step towards a siege economy.” The Economist.

- Gendreau, Brian and McLendon, Timothy (2016). 2016 Latin American Business Environment Report. Gainesville: University of Florida Press.